INCOME TAX RETURN DUE DATE FOR F.Y. 2022-2023

Income tax return filing has started for F.Y 2022-23. Before telling you anything let me tell you first that What is Income Tax Return?

Definition of Income tax return

Income that you earned during the financial year from sources and we have to pay tax on those incomes for the we file Income Tax Return.

Let’s discuss what are Financial year (F.Y.) and Assessment Year (A.Y.)?

Financial year

Financial is a period of twelve months in which income is earned. A financial year starts from 1st April and ends as on 31st march this is the time when you generate income. A financial year is commonly used in accounting to calculate the financial statement.

Assessment year

The Assessment Year is the 12 month-period that comes right after the financial year.

For example, the Assessment Year for any Income generated between April 1, 2022, and March 31, 2023, would be 2023-24. The assessment year is the year in which income is taxed and all taxes are paid and tax returns are filed. Always remember to file your Income Tax return within the relevant AY. You can file your return through us. we are growing company in this area and we have team of experts who are expertise in theses area. You can reach out to us by our website Trisuka.com, You can easily communicate to our executive by call or WhatsApp.

So, now you understood what is Financial Year and Assessment year. It is very important to know these terms specially if you are a taxpayer.

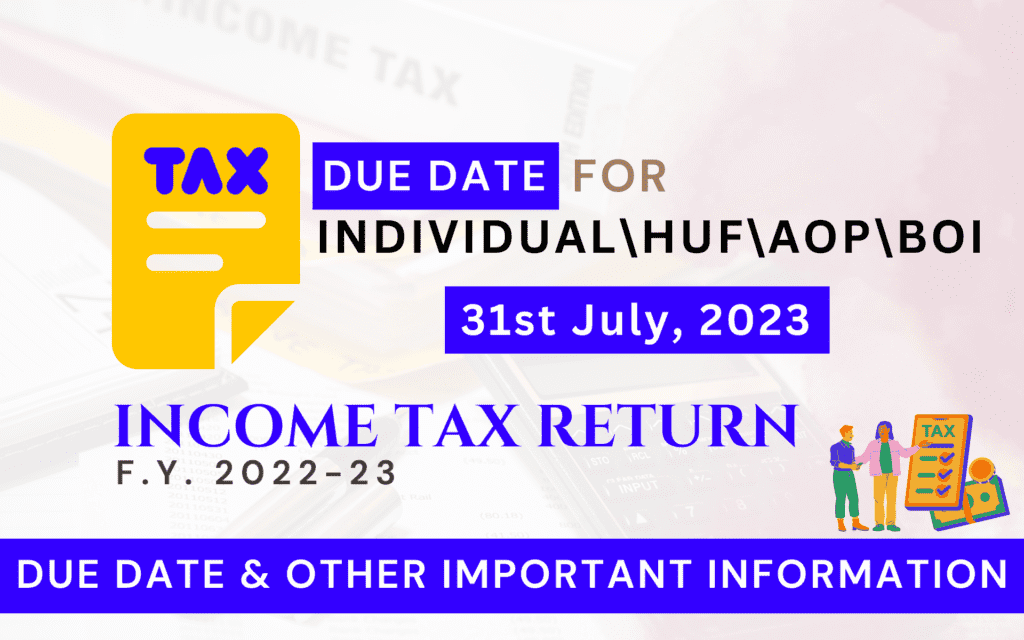

Here I am going to share with you all some due dates of filing return for F.Y. 2022-23 (A.Y.2023-24).

TAXPAYER | DUE DATE OF FILING FOR F.Y. 2022-23

|

INDIVIDUAL \ HUF\AOP\BOI (Those books of accounts not required to audited) | 31/07/2023 |

ORGNIZATION (That required Audited) | 31/10/2023 |

Revised Return | 31/12/2023 |

Belated or late return | 31/12/2023 |

What is a last date of filing ITR for F.Y 2022-23?

The last date of filing ITR for Financial year 2022-23 is 31st July 2023. Right now, it is a last date. we do not get any information about extending a date so, do not wait for the extension and file your return now.

Merits of Filing Income Tax Return on time.

- Easy Loan Process

ITR makes loan process easy. If you file ITR of at least three consecutive years then it makes your process easy. Example: Home Loan, Car Loan, and personal Loan.

- Income Proof

It is most genuine evidence of your income. It has your detailed Information about your annual income and the tax you have paid is available on the ITR. If you have need to submit your income proof, then it is one of the most – widely accepted Income proof.

- Quick Visa Processing

It makes your visa processing hassle free. The income and tax status are a necessary for international embassies so, if you are making plan to go foreign country then it will help you to make your process quick and easy.

- Claim Tax Refund

You can file Income Tax to claim your refund if you have paid higher than it was actual, so you can claim refund. When you file return then after verification, the tax department will deposit the refund directly on your bank account.

- Avoid penalties.

Late filing of ITR causes penalties. If you file return every year before the due date, you can save yourself from penalties. File your return on time to avoid such penalties.

Demerits of not filing Income Tax Return before due date

- Late fee.

In case you forgot to file return before due date then you to suffer from late fee. If you fail to file return on time, then late fee will impose on you and the charges would be RS. 5,000. It can be reducing to Rs. 1,000 if your Total Income is less then Rs. 5,00,000.

- Interest

If you submit your return after the deadline, you will be liable to pay interest at a rate of 1% per month or part month on the unpaid tax amount.

- Loss of Adjustment

In case you have incurred losses from sources. Example: the stock market, mutual funds, properties, or any of your businesses, you have the option to carry them forward and offset them against your income in the subsequent year. This provision substantially reduces your tax liability in the future years. However, you will not be allowed to carry forward these losses if you miss filing your ITR before the due date.

So, there are some advantages and disadvantages of Income Tax Return, if you want to get benefit of it, file your return on time and enjoy its benefits. We are filing right now, so you can choose us. We provide the best services. We have many happy costumers. We welcome you, you can easily communicate with us via. What’s app or call or mail.